Related Links

+ Knowledge Base

+ Technical Support Center

+ Training Videos

Applies To

| Spectra: | |||||

| myStratus: | |||||

Article Information

Reference #: HT 00017

Author: StephanieW

Created: 11.29.11

Last Revised: 05.12.16

How To: Document a Returned Check and Bank Fees

Summary

The instructions for documenting a returned check (and any associated fees) are different based on whether the original invoice has been posted or not. This article gives instructions for both scenarios.

Instructions

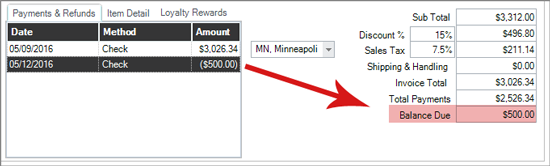

If the invoice has not been posted or has been posted but has pending payments on it:

- Add a refund to the invoice for the amount of the returned check. This will add the amount of the returned check back to the open balance on the invoice.

- Create a separate invoice for the bank fees.

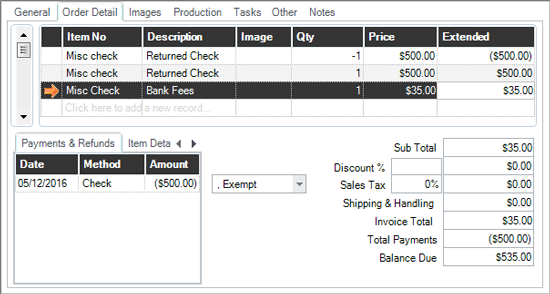

If the invoice has been posted and does not have any pending payments:

- Create a new invoice.

- Add a line item. Tip! Some people create a non-taxable item in their price list for returned checks, others just use a miscellaneous code.

- Use a quantity of "-1" and enter the dollar amount of the returned check.

- Next, add a refund in the amount of the bounced check to the newly created invoice. You can either use "check" method or "other." Your invoice total should now be $0. Tip! If your invoice isn't $0, most likely tax is being calculated. Either use a non-taxable item, or change the invoice sales tax to your exempt (0%) tax rate.

- Go back to the invoice line items and add another item with a quantity of "1" and positive amount for the returned check.

- You can also add a line item for the bank fees.

- Apply another payment to the invoice for the amount you have received to cover the bounced check and bank fees.

Additional Information

+ Online Help Topic(s) - Creating a Refund